Article |

Making Sense of EV Tax credits in the Inflation Reduction Act

We have been tracking the electric vehicle (EV) federal tax credit changes in the historic climate bill, the Inflation Reduction Act, which was signed into law on August 16, 2022. The massive bill includes provisions to lower carbon emissions including indirectly helping consumers to buy electric vehicles. The intention of the EV tax credit is to increase US battery material mining, battery production and EV assembling, and not penalize automakers who sell a high number of EVs while making EVs more affordable for middle- and lower-income consumers. Some of these tax credits have never been offered before. Lowering our carbon emissions and electric vehicles are a powerful way to move in the right direction. Below we break them down by EVs you can buy now through the end of the year and new and used EVs eligible in 2023.

Purchasing an EV Through 2022

If you are thinking about buying an EV, we have a list of eligible electric vehicles that still qualify for credits through the end of 2022 and met the final assembly in the US criteria and which vehicles will be eligible into 2023 and beyond based on IRS Section 30D. Our team can help if you have questions.

Used EV Tax Credit

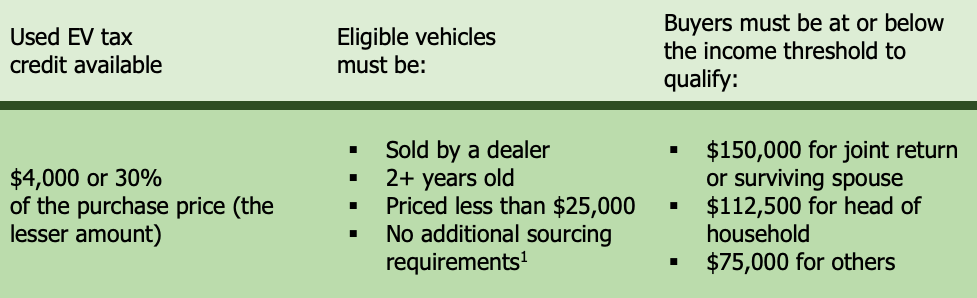

This is the first time the federal government has offered a used vehicle tax credit. This can be a game changer as two-thirds of Americans buy used vehicles. We are most excited about this as used cars are more affordable than new cars and at times have been more readily available. The used car credit, which begins in January 2023, will be very significant for EV buyers in the used market who qualify under these income caps ($150K joint, $112.5 head of household, $75K single filers). Used electric vehicles must be at least two years old, bought from an auto dealer, and the credit will be equal to the lesser value of either $4,000 or 30% of the sales price. The credit can be used once every three years for clean vehicles sold for $25,000 or less and would be based on the taxpayer’s adjusted gross income.

Starting in 2023, for the used EV tax credit boils down to:

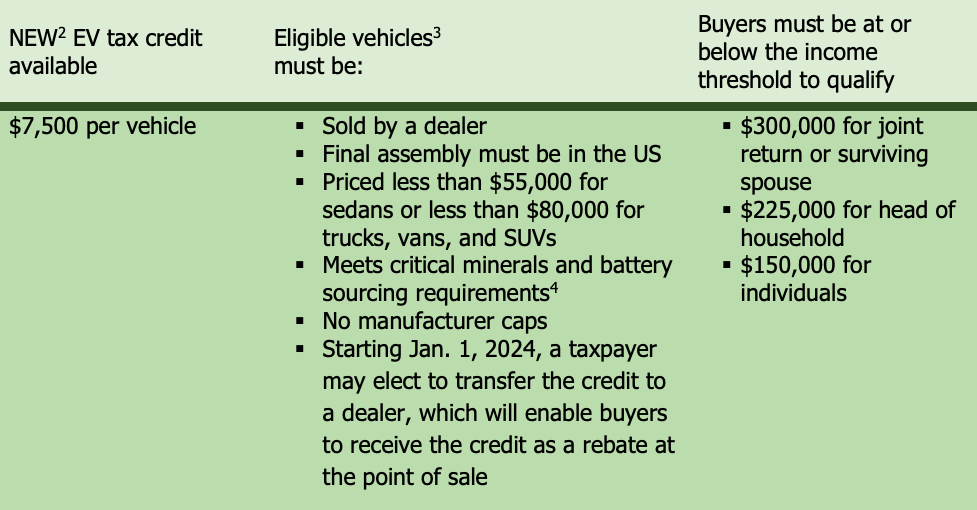

New EV Tax Credit in 2023

The EV tax credit begins on January 1, 2023 and has some significant changes from the previous tax credit for EVs that pertain to where the vehicles final assembly occurs, income caps, battery and rare minerals components, and automaker caps on EV sales. Removing the vehicle manufacturer cap means electric cars from automakers that already hit the cap, like Tesla, Toyota, and General Motors, will again be eligible. There will be some models of cars that will no longer be eligible for rebates until they can comply with requirements of the tax credit. Consumer Reports has summarized those models at the bottom of their article.

What This Means for Climate Goals

While all of this is a massive step in the right direction, climate scientists say the federal funding still falls short of what it will take to reach our 2050 climate goals. The feds are looking to the states to fill in the gaps and the League of Conservation voters compiled a list of actions taken by the states. California recently passed legislation to ban gas-powered vehicles by 2035, and Governor Newsom passed a climate bill which over the next five years will spend a record $54 billion on climate programs. This includes:

- $6.1 billion for improving electric vehicle access and infrastructure to accelerate transportation electrification

- $14.8 billion for transit, rail and port projects including California’s first-in-the-nation high-speed rail system and bicycle and pedestrian projects

- $8 billion to clean up and stabilize the electrical grid while providing relief to ratepayers

- $2.7 billion to reduce wildfire risks and enhance forest health

- $2.8 billion for short- and long-term action to better deal with drought through conservation, water resilience, and more.

We are excited to help you make the electric vehicle transition. If you still have questions, reach out to our bilingual EVs for Everyone/EVs para Todos team to learn more about these tax credits and what might be best for you now or beyond 2022. We will continue tracking the implications of all this climate spending and keep you updated on how it can help our region thrive.